private placement life insurance uk

Private placement life insurance A family office is well-equipped to help you put a private placement life insurance in place. UK US cross border financial planning.

Life Insurance For People Over 50 Bankrate

Private placement life insurance is a type of variable universal life VUL insurance1that allows investments contained within the policy to grow with income and capital gains taxes deferred.

. The PDF attachment explains what basic life insurance is and what types of people might require it. Vie International designs and implements offshore private placement insurance. It consists of a policyholder owning the policy and one or more lives assured together with appointed beneficiaries who will receive the proceeds from the policy upon.

Ultimately these deferred gains can be received income-tax free at the passing of the insured in the form of a death benefit. Fast Free Quotes With No Obligation. Private Placement Life Insurance PLLI also known as Unit-Linked Life Insurance is an established and internationally recognised tool for wealth preservation and transfer.

PPLIs are structured as variable universal life insurance policies. Private placement life insurance is a form of cash value universal life insurance that is offered privately rather than through a public offering. Is it a hard or a soft market and why.

Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public. Private Placement Life Insurance PPLI is a powerful wealth planning tool used by family offices and high-net worth individuals to invest in a tax efficient manner and transfer wealth to future generations more effectively. One solution to many of the changes can be to advise the client to invest in a life insurance policy such as a PPLI.

Our advice is independent. Ad Compare Top 5 Life Insurance Offers Now. Within our 1291 family you are connected to an international group of top professional experts in the field of private wealth solutions.

Private placement life insurance PPLI is a special type of life insurance that initially originates from the United States. Life insurance solutions are increasingly used by wealthy families as a wealth planning structure for wealth protection tax and estate planning andor as a privacy structure. At present PPLI policies are more often offered by banks hedge.

LIFE INSURANCE PRIVATE PLACEMENT LIFE INSURANCE A family office in the United Kingdom is well equipped to help you put a private placement life insurance in place. Private Placement Life Insurance PPLI. Private placement life insurance ppli is defined as a flexible premium variable universal life insurance transaction that occurs within a private placement.

Private placement life insurance PPLI is a variable universal life insurance policy that provides cash value appreciation based on. - current buyer. BlackRock Wells Fargo Private Banking John Hancock Zurich Crown Global and Pacific Life are among the most prominent providers of private placement insurance services and insurance-dedicated funds IDFs.

Life insurance solutions are increasingly used by wealthy families as a wealth planning structure for wealth protection tax and estate planning andor as a privacy structure. - current scenario of the pmi market. Private Medical Insurance Uk.

Recent Private Placement Life Insurance Inquiries. Following the 2018 US Tax Reform Act the use of private placement life insurance PPLI is becoming increasingly prevalent in the US but its benefits remain relatively less known outside of the US. Using PPLI as an investment vehicle has the potential to provide for complete tax deferral on investments held within the policy whilst allowing tax-free access to the funds invested over time.

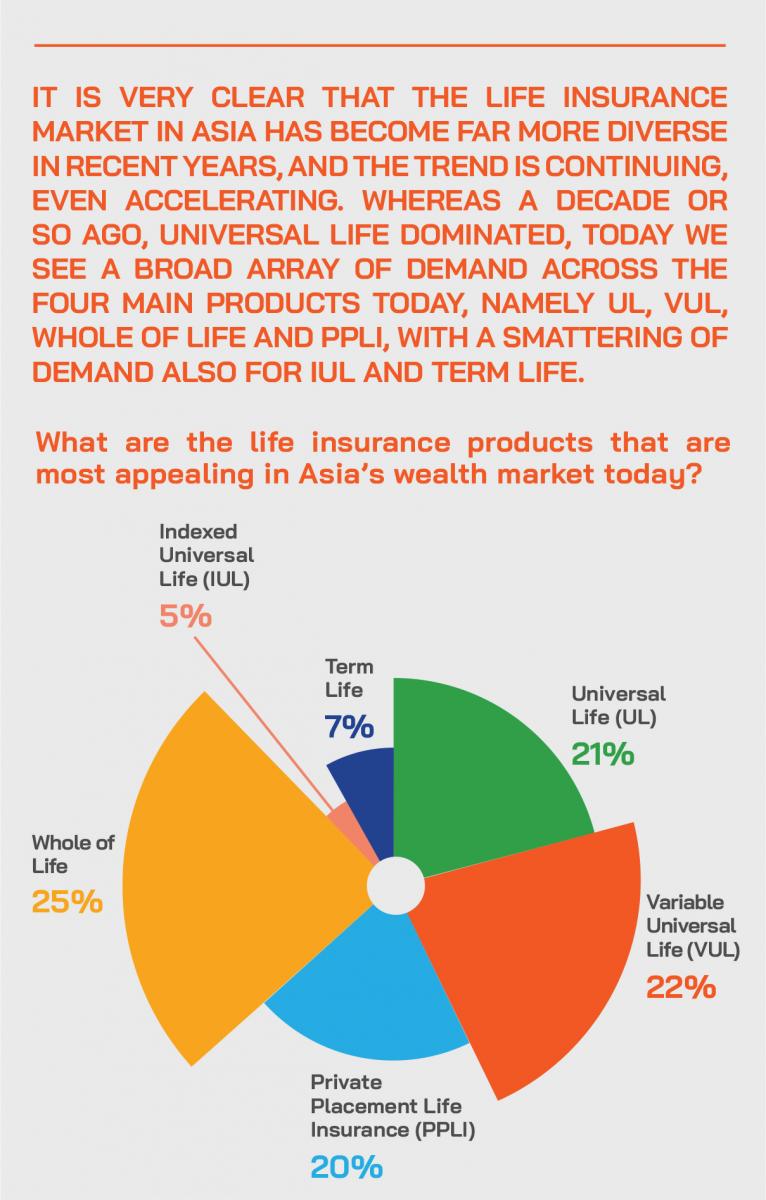

All in all private placement life insurance is income tax efficient while providing the owner with tax-free access to the policy cash values. In its most basic form PPLI is a type of permanent cover life insurance offering a broad range of investment options into which the insurance. PPLI products are seen in the UK and most of Europe and especially in Asia where there is general acceptance of.

Private placement life insurance uk. Private placement life insurance PPLI is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. Vie International has been a leader in the international private placement life insurance market for over a decade and has used private placement solutions for clients as part of pre-immigration planning to the US and the UK for trust investment tax and asset protection purposes.

What is private placement life insurance. Vie International offers a portfolio of financial services for individuals and organisations including life insurance health insurance annuities pensions cross-border estate planning group benefits and access to both UK and US investment platforms. With the authors.

Private Placement Life Insurance PPLI is a sophisticated vehicle that acts as an insurance policy that provides death benefit coverage while at the same time allowing for a variety of registered and non-registered investment options and a potential for significant growth in cash surrender value in a tax-efficient manner. Unlike traditional retail insurance PPLI is a unique type of insurance that takes advantage of insurance rules to avoid income taxation on internal income. Private medical insurance in uk i am trying to gain an understanding of the groupcorporate medical insurance market in uk with specific focus on the following areas.

There is no definition of private placement. Private placement life insurance ppli. The UK private placement regime is set out at Chapter 3 Part 6 of the Alternative Investment Fund Managers Regulations 2013 the AIFM Regulations and in Rules and Guidance in the Financial Conduct Authority FCA Handbook.

The Us Tax System Provides A Series Of Tax Reliefs For Us Tax Residents And Citizens Who Receive Income From Another Countr Financial Planning Tax Paying Taxes

High Net Worth Life Insurance Solutions Deutsche Bank Wealth

Life Insurance Coverage Gap Deloitte Insights

Matthew Ledvina Started Us Uk Tax Company Tax Advisor Accounting Services Investment Tips

Top 10 Pros And Cons Of Variable Universal Life Insurance

What Happens If You Lie On Your Life Insurance Application Bankrate

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

Ewp Tax Shield Part 3 Investing Real Estate Investing Capital Gain

Life Insurance Coverage Gap Deloitte Insights

New Book Coming Soon How To Introduce Yourself Michael Wit And Wisdom

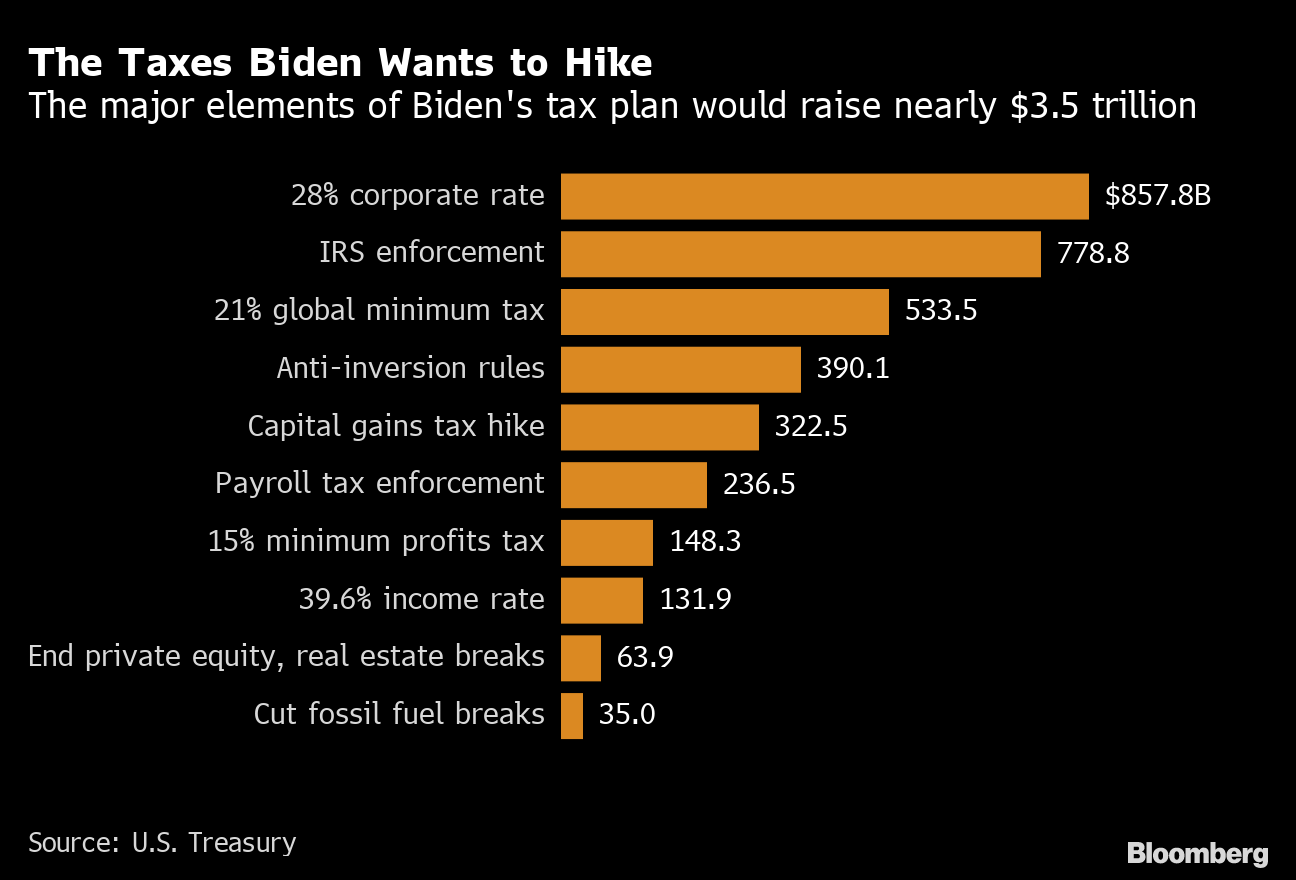

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Private Placement Life Insurance Ppli Considerations For Alternative Investments

Hnw Uhnw Life Insurance In Asia Opportunities Challenges For The World Ahead Asian Wealth Management And Asian Private Banking

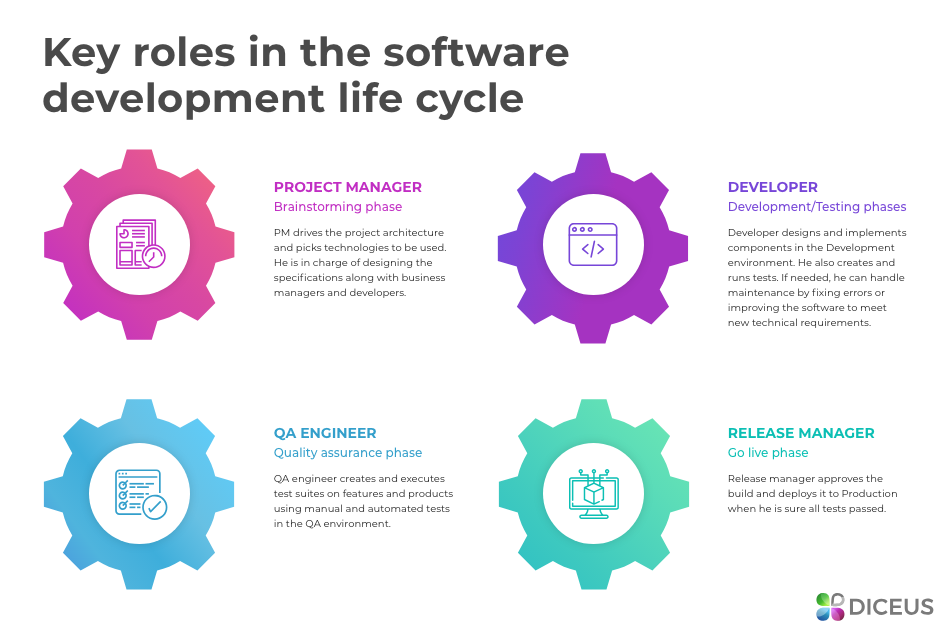

Step By Step Life Insurance Product Development Process

Ppli Is A Tax Avoidance Insurance Trick That S Only For The Uber Rich Bloomberg

Amazon Com Technical Analysis Of The Futures Markets A Comprehensive Guide To Trading Methods And Application Technical Analysis Analysis Future Of Marketing

Life Insurance Coverage Gap Deloitte Insights

Life Insurance Companies Are Betting Heavily On Corporate Credit Life Insurance Companies Insurance Company Insurance